So—You’re a Florida Property Actuary and SB 2-A Has Passed. Now What?

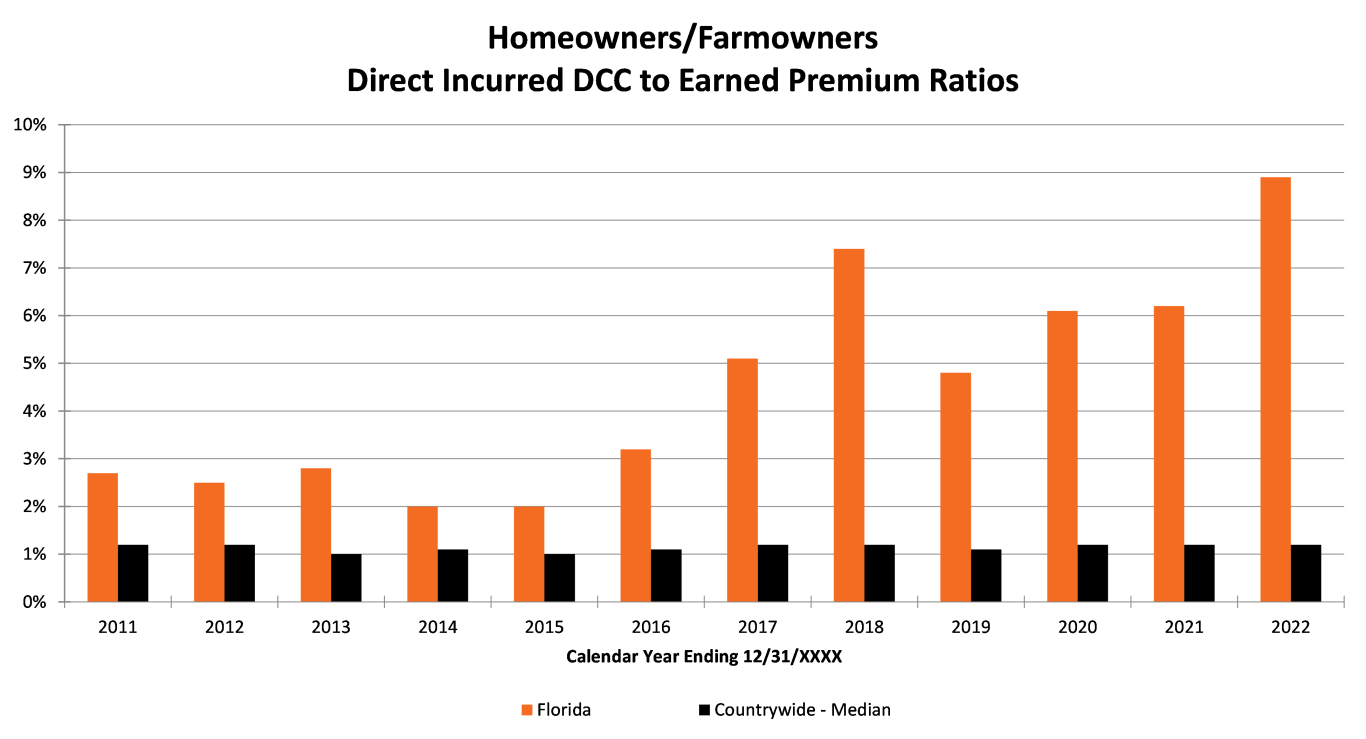

The Florida property insurance market has been one of, if not the most, tumultuous marketplaces in the insurance industry over the past decade. Driven primarily by a rise in assignment of benefit (AOB) and litigation claims (both of which increased significantly since 2016), the Florida property insurance market has recently seen some of its most unprofitable years in recent history.

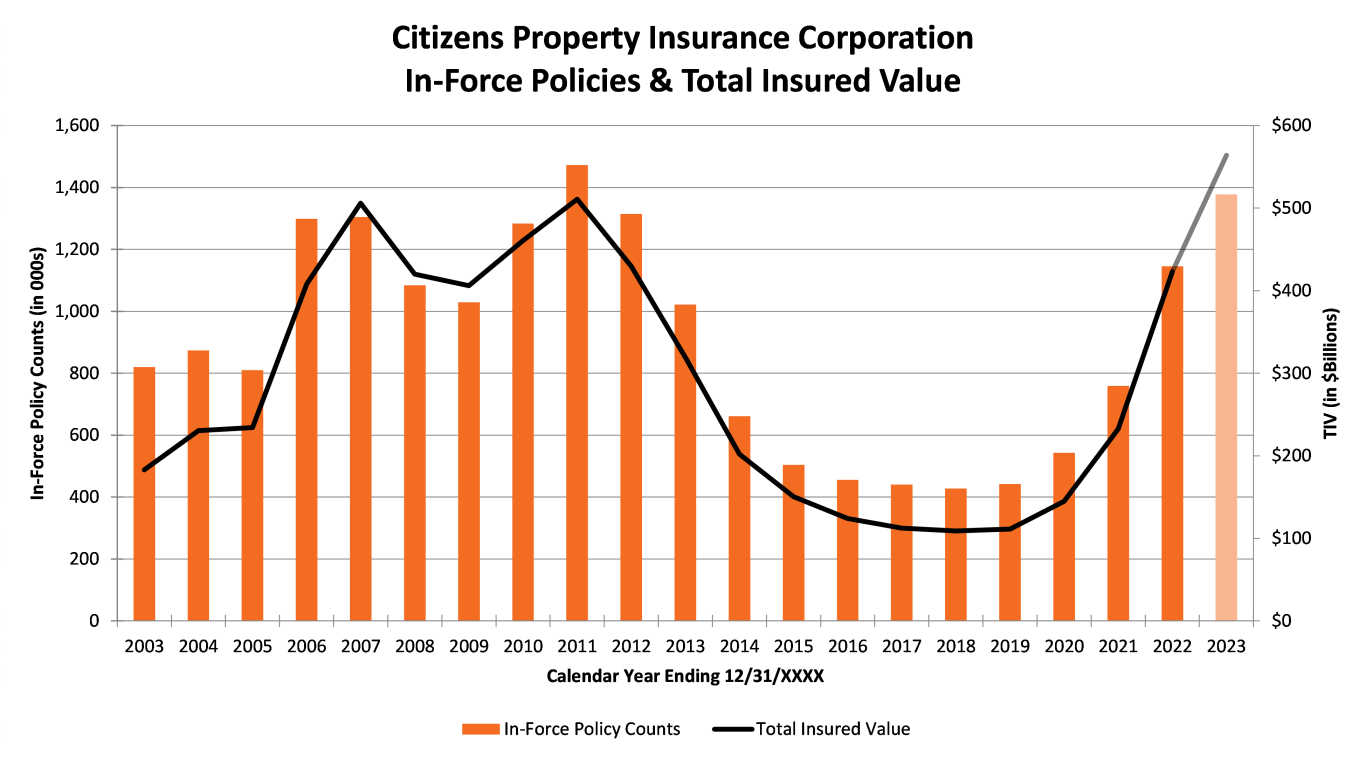

Since 2019, nine Florida property insurers have gone into liquidation. As a result, Citizens Property Insurance Corporation (Citizens), Florida's residual market for property insurance, saw its policy counts increase exponentially from 427,000 in 2018 to over 1.15 million by the end of 2022.

In response to these substantial headwinds, the Florida Senate passed Senate Bill 2-A (SB 2-A) in December 2022. The bill was designed to address several core issues that challenged the Florida homeowners market. Key provisions of SB 2-A included the following:

- Established the Florida Optional Reinsurance Assistance (FORA) Program to provide “reasonably priced” reinsurance for the 2023 hurricane season

- Repealed one-way attorney fees

- Note: Prior to SB 2-A, insureds were entitled to recover attorney’s fees in any lawsuit in which any additional amount of consideration was awarded to the insured. SB 2-A made each party responsible for their own respective attorney’s fees.

- Prohibited AOBs for policies issued on or subsequent to January 1, 2023

- Reduced the competitiveness of Citizens by:

- Increasing the eligibility threshold for Citizens personal lines residential risk policyholders that renew on or after April 1, 2023, and commercial lines residential risk policyholders upon becoming law

- Deeming policyholders ineligible from Citizens coverage if another company provides coverage within a 20% increase of what Citizens offers

- Allowing rate increases in excess of Citizens annual rate cap, also referred to as the glide path, for non-primary residences

The ultimate impacts of SB 2-A are still unknown, but the market reaction has already been significant. Since 2022, there have been nine new insurers that have entered the Florida property insurance market. Additionally, there has been increased interest in companies participating in Citizens' depopulation program providing companies opportunities to assume policies.

While the market reaction has been encouraging, there are several challenges that actuaries need to be mindful of, particularly as reserve studies for year-end 2023 begin in earnest. Some of those challenges include:

1. Tail risk. SB 2-A changes impact policies issued on or after January 1, 2023. Claims related to policies with an effective date prior to January 1, 2023, do not get the benefit of the changes from SB 2-A. This cutoff will impact legacy companies more than the newer entrants. There were 280,000 lawsuits filed just prior to when SB 2-A became effective.

2. Development patterns and trends. Another challenge will be assessing a reasonable benchmark for how 2023 and beyond will develop. In general, development patterns may be expected to accelerate due to decreased litigation, but determining how much may be difficult.

3. It's always something. Prior legislative measures have been implemented to address some of the issues plaguing the property market in the past—to varying degrees of success. Additionally, it remains to be seen if there will be any challenges to the SB 2-A legislation that could impact its intended benefits.

For actuaries, there are several avenues to pursue in analyses to account for the impacts of these changes including, but not limited to:

- Bifurcating data between litigated and non-litigated claims

- Bifurcating data by policy effective date. Accident year 2023 will be a mix of policies pre- and post-SB 2-A. Accident years 2024 and subsequent would realize the full benefit of SB 2-A.

- Splitting data for Citizens takeout policies if a company is participating in the Citizens depopulation program

- Applying separate loss development patterns to accident years 2022 and prior compared to accident years 2023 and subsequent

- Trend selection and development of accident year 2023 initial expected loss cost. This process is a balancing act when accounting for increasing inflationary pressures that continue to affect labor and material costs along with the mitigating effects of SB 2-A.

- Monitoring defense and cost containment expenses (DCC) to loss ratios. It's generally expected that DCC to loss ratios would decrease due to decreased litigation.

- Diagnostics. Simply looking at paid and reported (i.e., paid + case reserves) loss development triangles won't highlight how the underlying data may change post-SB 2-A. Having a suite of diagnostics can help identify shifts in the data that a more aggregated view may mask. Some examples are:

- Average case reserves

- Claim closure ratios

- Average cost per exposure

- Paid as a percent of prior case reserve

- ALAE to loss ratios

There isn't one single solution for reflecting the changes of SB 2-A given how recently it was enacted. There are many considerations to make, and it will be essential to coalesce quantitative and qualitative observations from discussions with company management to get a reasonable indication from the data provided. Ultimately, prudence will be needed as SB 2-A’s changes play out and how they impact the loss experience within the Florida property marketplace.