Captive Actuarial Value

Aaron Hillebrandt said he enjoys educating captive boards and owners about the actuarial process and core actuarial judgments. “The goal is to help create an environment between the actuary and the client where they understand some of our assumptions and they’re comfortable asking questions and challenging some of the judgments that we’ve made,” he said. The following are excerpts from an interview.

How well does the captive market understand actuarial capabilities?

Among captive owners and managers, there is a good understanding of basic actuarial services. For example, any prospective captive will need an actuarial funding analysis and pro forma financial statements to incorporate into the captives feasibility study. For an established captive, it will need an actuarial renewal funding analysis on an annual basis and a loss reserve analysis, at least on an annual basis.

Does the captive manager handle the pro forma portion of the feasibility study?

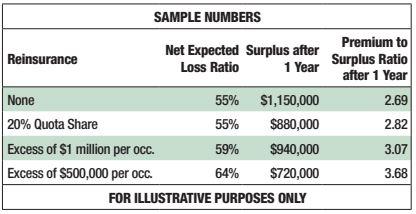

Oftentimes, they do. Sometimes, we are asked to help with the pro forma financial statements. Perhaps this is an area where the captive could get more value from their actuary. The captive may be considering multiple reinsurance options, and we can help optimize that process. If you think about projected loss ratios, surplus accumulation, leverage ratios, all those things are going to depend on the expected losses as modeled by the actuary under the various options. Our table (see graphic) shows various reinsurance scenarios as rows, and it shows different numerical values in the columns. Under the “no reinsurance” scenario, you see a net expected loss ratio of 55%. After the first year, you see accumulated surplus of $1.15 million and a premium to surplus ratio of 2.69. Now, in the subsequent rows, you see the effects of several reinsurance options (assuming no excess claims).

Does client level education ever go beyond actuarial assumptions?

Absolutely. Anytime that data’s involved, the actuary can add value. For example, with presenting data graphically. There are a lot of defaults out there that can unintentionally muddy the story that the data is trying to tell.