Captive Insurance Companies Association (CICA) Conference

Below is an excerpt from the conference report authored by IRMI's Hugh Rosenbaum and Mike Mead.

At this CICA meeting, the original (and inappropriate) name of 831(b) captives, after a section in the tax code, was replaced with the terms “small captives” and “enterprise risk captives.” The CICA program scheduled two “small captive” presentations, including the following session.

Second Small Captive Session

This presentation was called Unique Regulatory Considerations for Captives and ERCs. In this one, captives are referred to as enterprise risk captives (ERCs), a term that may turn out to be the one that sticks better than “small” captives. The panelists were two regulators and an actuary, with Jeff Kehler of South Carolina doing a lot of the talking. Michael Corbett was the other regulator, with Aaron Hillebrandt of Pinnacle Actuarial Resources, Inc., the actuary.

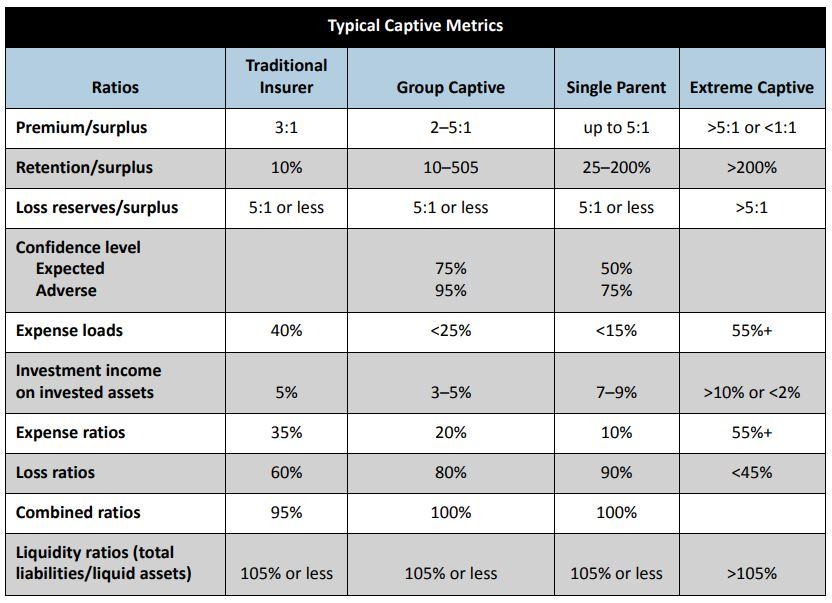

Unlike many CICA sessions where panelists expressed lots of generalities with very little detail, this session had a lot of detail, numbers, and measuring points of use to all. It was revealing to hear what kind of ratios and judgment factors regulators use to assess ERCs as well as other captives. Some of their material was based on the original standards Tillinghast, and then Towers Perrin, put in their reports in 1990–2006. The session usefully compared standards for standard captives compared to ERCs and the commercial insurers and seemed to focus on ERCs ab initio, but the ratios can be used for ongoing judgments, too.

CICR comment: They used the term “unique” in the title but never mentioned any uniqueness in the presentation that we heard.

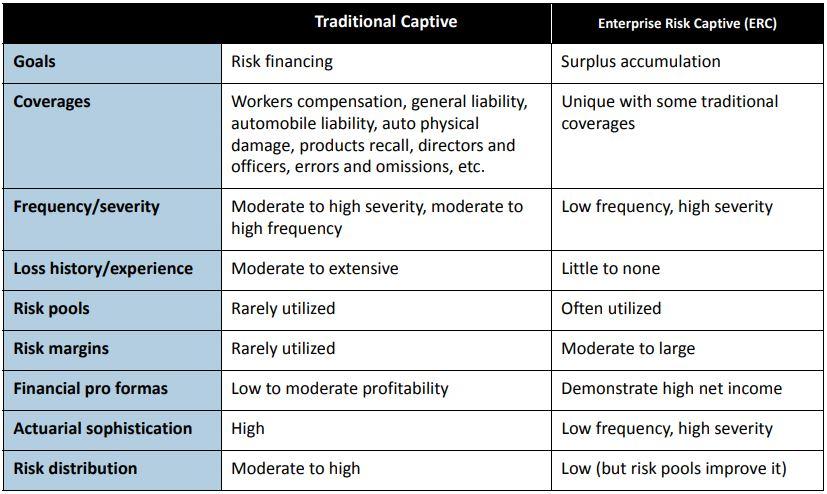

A graphic similar to what they discussed is presented below. Note the comparison with traditional commercial insurance.

An extreme captive, by the way, is just what the label implies. “I’ve seen some extreme ones,” commented Mr. Kehler.

We were especially interested in the “risk margin” standard put forward. An ERC was shown to have typically very high-risk margin, up to 400 percent. Mr. Hillebrandt said that for the usual kind of lines a captive writes, 10–40 percent is normal, but ERCs write nonstandard ones.

Mr. Kehler’s comments on these metrics follow. First of all, the three most important metrics of importance to regulators from the list on the previous page are the following.

- The premium to capital ratio. If less than 1:1, the risk will seem higher and “the regulator will make a call.”

- The risk to capital ratio. The 10 percent rule for traditional insurers is too low for captives, says Mr. Kehler. For ERCs, 50 percent and up is more normal, with some of them going to 200 percent and above.

- Loss reserves to capital maximum 5:1 is important. If they have underestimated reserves by only 10 percent, they have impacted up to 50 percent of the capital.

Confidence level: it used to be 90th and 75th for group captives or single-owner captives. Now, the confidence level the actuary selects is more important, and for the adverse loss case, there has to be capital enough to meet that 95th percentile confidence level.

CICR comment: Shades of Solvency II—the same high ratio.

Regulators are growing more interested in expense loads, especially for ERCs. In the table above, they are shown as being up to 50 percent.

The combined ratios for ERCs are always low—too low for some regulators in spite of those high-expense ratios. Again, that has a lot to do with the expected losses being low (or zero).

The liquidity ratio, the ratio of total liabilities to liquid assets, is important to regulators because if greater than 105 percent, it will “need explaining.” Mr. Kehler didn’t say it, but in ERCs, where liabilities on the books are low, this ratio will be generated by the pool in which they participate—unless the other participants also have no liabilities.

CICR comment: A meaningless ratio when applied to many ERCs.

Other ratios were added by the panel’s actuary, who looks at the following.

- Premium to total retention equals rate on line. What if 50 percent? This means claims volume is expected. If this ratio is too low, implying not, it will be questioned.

- Premium to total revenue of the owner. Apparently, this can be compared among industry groups if those figures are available. He didn’t say what ratios were “normal,” but he said ERCs could be higher because owners are often smaller.

The nature, scale, and complexity of risks are involved with the source of the data on which rates and capitalization are based. While the traditional insurer uses its own loss data, an ERC may use loss data based on others’ experience, or even, in the absence of loss data, use exposures instead. The more regulators see little credible data, the more it “changes their view,” which seems self-evident. What about too little data? This can also change the regulators’ view. And, since risk distribution is “a challenge for ERCs,” they often go in for participation in pools.

CICR comment: That’s generous. We think the main reason they participate in pools is for tax-defense purposes.

Another way of managing expected adverse deviation of risks with high-severity and low (or no) frequency is to add in a line where there are losses, like deductible funding, for instance.

This session also revealed the attitude of actuaries on the continuum between a lot of one’s own loss data to no loss data at all. Experience rating, based on losses, will be replaced by exposure rating, where the judgmental factors are higher. “It’s similar to what commercial insurers do for rate-setting in the higher layers,” said Mr. Hillebrandt. But one has to be careful about using pure simulation in the primary layer for an ERC, which can be the cause of some “discussion” with the regulator at the outset.